Care service manager jobs

Do you share our vision to end youth unemployment?

The King’s Trust is seeking an exceptional individual to become Director of Delivery for Wales.You should share our passion for supporting young people to realise their potential and increasing our reach and impact.

You will lead a team of colleagues, delivery partners and volunteers to turn our strategy into action, ensuring that our programmes reach those who need our help the most, by building partnerships, upholding our commitment to inclusion and safeguarding and growing our income. You will also develop and implement plans to achieve our four strategy goals of Tackling Inequality, Building the Nation’s Workforce, Being a Bold Voice for Change and Making Every Pound Count.To do this, you’ll need to able to engage and motivate a dispersed team and collaborate effectively across the whole organisation. You’ll also need to have an understanding of the challenges facing young people.

You will be a member of the Trust’s Senior Leadership Team, working with colleagues across the UK and will lead on a number of cross organisational projects.You’ll need to be visible across Wales and the wider organisation, working in our centre in Cardiff at least three days a week, as well as travelling to other centres and partner meetings in Wales and the UK as required.

We believe that every young person should have the chance to succeed, no matter their background or the challenges they are facing.

The client requests no contact from agencies or media sales.

After a successful Inspiring Minds Campaign that raised £50m over a 10-year period and achieved the goal of providing bursaries to 1 in 4 pupils, the Latymer Foundation is now entering a new strategic period. A new three-year strategy will sustain and grow bursary provision, driving us towards the goal of achieving needs-blind admissions, whilst positioning Latymer as the independent school that sets the global standard for access, inclusion and opportunity.

Within this context, the Head of Philanthropy will play a vital role in securing the financial resources that sustain Latymer’s sector-leading bursary programme, ensuring that talent, not financial circumstance, determines access to a life-changing Latymer education.

The Head of Philanthropy role will have a strong personal focus on major gifts fundraising, whilst overseeing all philanthropic income streams — Major Gifts, Regular Giving and Legacies.

Salary circa £75,000 per annum, dependent on experience.

To apply and find out more about the school and our attractive staff benefits package, please visit our dedicated recruitment website via the Apply button.

Closing date: 9.00 am on Monday, 23rd February 2026.

Interviews 1st Round (Virtual) – Tuesday 3rd & Wednesday 4th March 2026.

Interviews 2nd Round (In-person at Latymer Upper School) – Wednesday 11th March 2026.

Diversity – The School is fully committed to the principles of equal opportunity, diversity and inclusion. We have an established and representative staff Equality and Diversity Board to help drive forward positive change. A further Equality and Diversity Committee has recently been formed from our student population.

We are committed to attracting and retaining the very best staff, ensuring that our staff body reflects the diversity of our students and local community. Acknowledging a lack of ethnic diversity within our Support Staff community, we particularly encourage applications from Black, Asian and Minority Ethnic candidates for this role. All appointments will be made on merit, following a fair and transparent process. In line with the Equality Act 2010; however, the School may employ positive action where diverse candidates can demonstrate their ability to perform the role equally well.

The School is committed to safeguarding and promoting the welfare of children and young people. All posts are subject to an enhanced DBS, online checks and receipt of two satisfactory references.

We are looking for a resilient and dedicated person to join our Avon & Somerset team as Early Interventions Officers, working within the VS team as part of the Avon & Somerset Victim Service partnership.

The service provides support across the whole geography of Avon & Somerset. This role involves making initial contact with victims of crime and Anti-Social Behaviour and providing initial support in a dynamic and ever-changing environment. The role is full-time and based at out office in Bristol office.

Do you want to make a difference every day? Do you want to contribute to change & improvement for those who need it?

Do you have resilience & adaptability? Can you work effectively with a focus on customer service and care?

If yes, then we'd love to hear from you…

What we offer

At Victim Support, we are committed to attracting and retaining the best talent. Our competitive rewards and benefits package includes:

- Flexible Working Options: Including hybrid working.

- Generous Annual Leave: 28 days plus Bank Holidays, increasing to 33 days plus Bank Holidays, with options to buy or sell annual leave.

- Birthday Leave: An extra day off for your birthday.

- Pension Plan: 5% employer contribution.

- Enhanced Allowances: Enhanced sick pay, maternity, and paternity payments.

- Exclusive Discounts: High Street, retail, holiday, gym, entertainment, and leisure discounts.

- Financial Wellbeing: Access to our financial wellbeing hub and salary-deducted finance.

- Wellbeing Support: Employee assistance programme and wellbeing support.

- Inclusive Networks: Access to EDI networks and colleague cafes.

- Sustainable Travel: Cycle to work scheme and season ticket loans.

- Career Development: Ongoing training and support with opportunities for career progression

About the Role:

You will provide high quality support to all victims and witnesses of crime and Anti-Social Behaviour, leading on completing initial impact and risk assessments that are comprehensive and holistic. You will also provide cover for the local VS Helpline.

Key Responsibilities:

- Act as the first point of contact for service users referred in to the service, completing comprehensive impact and risks assessments using agreed processes and a tailoring the response to each individual's needs.

- Manage a caseload of service users who require more immediate and short term interventions, referring on those with more long term needs either internally or externally.

- Develop support plans where appropriate.

- Maintain accurate and confidential case management records and contribute to monitoring information for the service and provide accurate and timely performance information for internal and external use.

- Respond appropriately to safeguarding concerns including both child protection and vulnerable adult issues.

- Ensure that everyone is aware of their rights under the Victim's Code of Practice and the Witness Charter..

- Comply and keep up to date with all relevant legislation, policies and procedures, including data protection legislation, confidentiality.

- Work as part of a team to ensure that all outcomes and Key Performance Measures are met relevant to the local contract.

Ideally you will have:

- Experience of delivering a service and working directly with service users in a statutory, voluntary or community work setting

- Experience of working in an outcomes focused service

- Knowledge of the criminal justice system and the impact of crime

- Knowledge and understanding of Domestic Abuse processes and services

- Experience of engaging with vulnerable victims of crime who may have complex needs

You will need:

- Strong written & verbal communication skills.

- Good time management skills.

- Competent IT skills, able to use generic systems.

- To work effectively both as part of a team & independently

- To develop & maintain partnerships with external organisations.

- The ability to undertake impact & risk assessments.

- Knowledge of safeguarding issues & legislation related to child protection & vulnerable adults.

About Us:

Victim Support is an independent charity dedicated to supporting people affected by crime and traumatic incidents in England and Wales. We put them at the heart of our organisation and our support and campaigns are informed and shaped by them and their experiences.

Victim Support are committed to recruiting with care and to safeguarding and promoting the welfare of children, young people and vulnerable adults and expects all staff and volunteers to share this commitment. Background checks and Disclosed Barring Service checks may be required.

At Victim Support, we're proud to celebrate diversity and create a workplace where everyone feels they belong. We're committed to being an antiracist organisation, and we actively welcome applications from people of all backgrounds, including those from Black and Asian and other minoritised communities.

As a Disability Confident Employer, we will offer an interview to disabled candidates who meet all essential criteria for a job where it is practicable to do so. We are also happy to make reasonable adjustments during the recruitment and selection process.

How to apply:

To apply for this role please follow the link below to the Jobs page on our website and complete the application form demonstrating how you meet the essential shortlisting criteria.

We reserve the right to close this vacancy early, if we receive enough suitable applications to take forward to interview prior to the published closing date. If you have already registered & started an application, then we will contact you to advise of the amended closing date wherever possible.

Salary - £33,139 - £38,908 per annum

Location – South West of England - Home or Hybrid working options, with regular travel within the region

Could you help turn every mile, mountain, marathon, or muddy challenge into life-changing support for children and families? Are you energised by epic challenges, unforgettable experiences, and the chance to make a real difference?

We’re looking for a creative and driven Challenge Events Fundraiser to help shape and grow an inspiring portfolio of fundraising adventures—across the South West and beyond.

You will:

- Build and grow an exciting programme of challenge events across the South West, nationally and internationally, that raise vital income and deliver memorable moments for every participant.

- Collaborate closely with our fantastic Events Fundraising team to offer a diverse, high-performing range of events that hit ambitious financial targets.

- Champion exceptional stewardship, working hand-in-hand with the wider Fundraising and Marketing teams to ensure every supporter feels valued, supported, and inspired throughout their entire journey.

What you’ll bring

- A love of events, adventure, and people

- Demonstrable experience of great organisational flair and creativity

- Confidence and experience in building relationships and motivating supporters

- A collaborative spirit

- Proven experience of events and challenge fundraising or events/project management

Please see the Job Description and Person Specification for full details of the job role and what you will need to be successful.

About Us:

We are an established and successful charity providing hospice care for children with life limiting conditions and their families in the South West of England.

We aim to recruit passionate, friendly and enthusiastic staff who are motivated to really make a difference to the lives of the children and families who visit us.

Join our team for a rewarding career move where 98% of staff agree that they are proud to work for CHSW.

What we offer:

We value our staff and offer an excellent working environment with an enthusiastic and committed team, you will also benefit from:

- 33 days (plus bank holidays) holiday entitlement, which increases with service

- enhanced sick pay scheme rising up to 6 months full and 6 months half pay*

- personal pension scheme with 7% employer contribution

- family friendly policies, with enhanced maternity/adoption pay

- occupational health, wellbeing and counselling services and employee assistance programme

- group life insurance scheme

- training and development opportunities

- environmental and green agenda

- a supportive and inclusive environment

- a chance to make a real difference

Closing date: 20/02/2026

Anticipated Interview date: 03/03/2026

Please note: We may close this vacancy early if sufficient suitable applications are received; therefore we recommend you apply early

CHSW Equality, Diversity and Inclusion Statement

CHSW is committed to safeguarding and promoting the welfare of children and young people and all employees must apply for an enhanced disclosure from the Disclosure and Barring Service. We welcome applications from all sections of the community.

Charity Registration Number 1003314

REF-226 494

At Hestia, we are guided by our core values and are dedicated to fostering an equitable, diverse, and inclusive organisation. Our mission is to empower individuals to rebuild their lives and achieve independence. Right now, we are looking for a Recovery Outreach Worker to play a pivotal role in our Oremi Centre in Notting Hill.

Sounds great, what will I be doing?

You will be providing holistic, person‑centred support to a group of allocated service users, using SMART planning and the recovery approach to promote independence, stable accommodation and a good quality of life. Your role includes visiting individuals in their homes or community settings, creating effective interventions for those who are hard to engage, and encouraging involvement with community and faith-based networks. You will support access to medical and mainstream services, complete and review needs and risk assessments, and work to reduce unplanned hospital admissions. You will also develop and review support plans collaboratively and liaise with external agencies to ensure coordinated care.

What do I need to bring with me?

You'll need to be able to demonstrate the core skills this role requires as well as match our values and mission. You don't have to tick all the boxes right away; the important thing is that you're willing to learn. We also value lived experience of the areas we support, so if you feel comfortable, please do mention this on your application.

You will bring experience of supporting people with mental ill health and complex needs, along with a strong background in community‑based or outreach work. The role requires the ability to help service users achieve their goals, underpinned by excellent knowledge of mental health symptoms, treatments and early signs of decline. You will understand health and safety in community settings, person‑centred planning and the recovery approach. A commitment to equality, diversity, dignity and choice is essential, as is awareness of welfare benefits. You will also demonstrate solid safeguarding knowledge and the confidence to act appropriately when concerns arise.

Interview Steps

We keep our interview process simple, so you know exactly what to expect.

- Shortlisting call: We have a team of dedicated recruitment specialists who will speak to you about your experience, motivations and values. They will also tell you about all the great work we do!

- Face to face interview: Now you will have face to face interview with the hiring manager. Our interviews are value and competency based.

Don't be alarmed if there are other stages in the process, it's all part of the plan for some of our roles.

Our commitment to Equality, Diversity, and Inclusion

Our services users come from all walks of life and so do we. We hire great people from a wide variety of backgrounds because it makes us stronger. We are committed to creating and maintaining a diverse and inclusive workforce and value the skills, abilities, talent and experiences, different people and communities bring to our organisation.

We are a disability confident employer

Hestia is proud to be a disability confident employer, dedicated to the employment and career development of individuals with disabilities. We offer a guaranteed interview scheme for all applicants with disabilities who meet the minimum criteria for the role they have applied for. We also provide reasonable adjustments during the selection and interview process, and throughout your employment with us.

Safeguarding Statement

Hestia is committed to safeguarding and promoting the welfare of adults, children and young people who are potentially at risk, and we therefore expect all staff and volunteers to do the same. We require all staff to undertake internal and external safeguarding training throughout their employment with Hestia.

Important Information for Candidates

If your application is successful, please be aware that you will be required to undergo pre-employment checks before a formal offer of employment can be confirmed.

We reserve the right to close this job advert early should we receive a high volume of applications or if the position is filled before the closing date. We encourage interested candidates to apply as soon as possible to ensure their application is considered.

We deliver services across London as well as campaign and advocate nationally on the issues that affect the people we work with.

Right now, millions of people across the UK are living with financial insecurity. Parents are choosing between heating and food. People who fall ill find themselves unable to work and without support. Countless others lie awake at night worrying about bills they cannot pay. At Turn2us, we believe none of us should have to face these challenges alone - and we exist to change the systems that allow them to persist.

Turn2us is working towards a future where everyone in the UK has financial security so they can thrive. We combine direct support and innovative digital tools, such as our online Benefits Calculator and PIP Helper, with influencing, policy and systems change. Across our organisation, colleagues bring deep expertise, compassion and ambition, united by a shared belief that financial hardship is not a personal failing, but a systemic issue that can and must be changed.

The Income & External Affairs Directorate plays a critical role in making this vision a reality. Through relationship-led fundraising, commercial partnerships, communications, and policy and influencing work, the directorate ensures Turn2us has the resources, profile and voice needed to maximise our impact. It connects our work with the people, organisations and institutions that can help drive lasting change. While we have built strong momentum and significant partnerships in recent years, we know there is far more potential to realise.

As Director of Income & External Affairs, you will be a key member of our Leadership Team, working closely with colleagues across the charity and with our Board. You will lead the growth of sustainable income, develop powerful and values-led partnerships, strengthen our public voice, and help shape a policy and advocacy agenda grounded in the experiences of people facing financial hardship. You will also play a vital role in building trust, credibility and influence across sectors to help shift the systems that keep people locked in financial insecurity.

We are looking for an exceptional and values-driven leader with a strong track record in relationship-based income generation, partnerships and influence. This experience may come from the charity sector or a commercial environment. We are not seeking a specific career path or background; instead, we actively welcome applications from people who bring new perspectives, transferable skills and different ways of thinking. What matters most is a deep commitment to our purpose, a willingness to learn and the confidence to lead with curiosity and humility.

This role calls for persuasive leadership, emotional intelligence and the ability to build trust across diverse teams and stakeholders. You will thrive if you enjoy working collaboratively, sharing power and leading in a way that is inclusive, supportive and ambitious.

This is a genuinely exciting and critical role - for our staff, our partners, and most importantly, for the people we exist to serve. We are particularly keen to hear from people with lived experience of financial insecurity. If you share our values and feel inspired by our vision of a more just and financially secure society, we would love to hear from you.

To download a full copy of the candidate brief and learn more about the role, please click the ‘Apply’ button, where you will be redirected to the website of our recruitment partner, Tall Roots. Applications should include a CV and covering letter. If you would like an informal discussion about the role, please email Mark Crowley at Tall Roots.

Actively Interviewing

This organisation is scheduling interviews as applications come in. They're ready to hire as soon as they find the right person. Don't miss your opportunity, apply now!

Contract Type: Permanent

Location: Lancashire

Assessment Cente: 24th of February in-person

Are you ready for an adventure-filled role that makes a real difference? As a Youth Development Lead, you can expect to spend four days a week outdoors, delivering life-changing programmes to vulnerable young people, rain or shine. With activities like bushcraft, paddling, climbing, and hill walking, you’ll use your skills to inspire confidence and build resilience. Your hands-on approach will help break down barriers and empower young people to reach their potential.

Ideal candidates will have experience working with vulnerable individuals and delivering outdoor learning programmes. While your week will be spent mostly delivering sessions outdoors, expect one day a week at a desk planning sessions and recording data. If you thrive in dynamic environments and are passionate about supporting young people through meaningful, adventurous experiences, we want to hear from you!

What happens next?

Please submit a CV, and Cover Letter that includes your experience, transferrable skills and motivation to work for The King's Trust! The Team will be in touch about the next steps shortly after the closing date.

Why do we need Youth Development Leads?

Last year, we helped more than 40,000 Young People, with every three in four moving into a positive outcome for either work, education or training. Youth Development Leads play a crucial role in supporting young people, no matter the young person's background or current circumstances, to fulfil their full potential. We want to continue having a positive impact on young people’s lives and we couldn’t do this without the important work of Youth Development Leads!

Perks for working at The Trust!

- Great holiday package! 30 days annual leave entitlement, plus bank holidays. Office closure on the days between Christmas and New Year

- Flexible working! Unless the location of the role is remote, the Youth Development Lead role requires a combination of office days and working from home.

- You can volunteer for and/or attend events – The King's Trust Awards, Pride, active events etc.

- In-house learning platform! Develop your skills for your career and your role

- Benefits platform! Everything from health and financial well-being support to discounts on your favourite restaurants, shops and cinemas.

- Personal development opportunities through our Networks – KT CAN (Cultural Awareness Network), KT GEN (Gender Equality Network), KT DAWN (Disability & Wellbeing Network), and PULSE (LGBTQIA+ Network).

- Fantastic Family leave! Receive 13 weeks of full pay and 13 weeks of half pay for maternity and adoption leave. Receive 8 weeks of full pay for paternity leave.

- Interest-free season ticket loans

- Cycle-to-Work Scheme

- The Trust will contribute 5% of your salary to the Trust Pension Scheme

- Generous life assurance cover (4 x annual salary)

We believe that every young person should have the chance to succeed, no matter their background or the challenges they are facing.

The client requests no contact from agencies or media sales.

We have an exciting opportunity for an Independent Domestic Violence Advisor covering the Stoke Area to join the New Era team working 37.5 hours per week. The role will focus on the identifying risk and meeting the needs of those affected by domestic abuse. The role will be covering the Tamworth area but travel across Staffordshire will be required.

Do you want to make a difference every day? Do you want to contribute to change & improvement for those who need it?

Do you have resilience & adaptability? Can you work effectively with a focus on customer service and care?

If yes, then we'd love to hear from you…

What we offer:

At Victim Support we believe in attracting & retaining the best people and offer a competitive rewards & benefits package including:

- Flexible working options including hybrid working

- 28 days annual leave plus Bank Holidays, rising to 33 days plus Bank Holidays

- An extra day off for your birthday & options to buy or sell annual leave

- Pension with 5% employer contribution

- Enhanced sick pay allowances, maternity & paternity payments

- High Street, retail, holiday, gym, entertainment & leisure discounts

- Access to our financial wellbeing hub & salary deducted finance

- Employee assistance programme & wellbeing support

- Access to EDI networks and colleague cafes

- Cycle to work scheme & season ticket loans

- Ongoing training & support with opportunities for career development & progression

About the role:

This role will work across Staffordshire and Stoke on Trent, but will be based in our Stafford office. Hybrid working is considered following our mandatory six month probationary period. Travel across the whole of Staffordshire will be required.

As an IDVA you will be asked to:

- Provide a pro-active, high quality, frontline service to victims of domestic abuse through on-going risk assessment, individual safety planning, advocacy, emotional and practical support.

- Work within a multi-agency framework consisting of the MARAC and local partnership responses to domestic abuse to keep safety central to all services for victims of domestic abuse

- Promoting the service and raising awareness of issues arising, minimising barriers and improving access to support

You will need:

- Experience of providing support those affected by domestic abuse

- Experience of undertaking need and risk assessments and creating safety plans

- Experience of the MARAC and other partnership processes

- Experience of multi agency working

Please see attached Job Description and Person Specification for further details.

About Us:

Victim Support is an independent charity dedicated to supporting people affected by crime and traumatic incidents in England and Wales. We put them at the heart of our organisation and our support and campaigns are informed and shaped by them and their experiences.

Victim Support are committed to recruiting with care and to safeguarding and promoting the welfare of children, young people and vulnerable adults and expects all staff and volunteers to share this commitment. Background checks and Disclosed Barring Service checks may be required.

At Victim Support, we're proud to celebrate diversity and create a workplace where everyone feels they belong. We're committed to being an antiracist organisation, and we actively welcome applications from people of all backgrounds, including those from Black and Asian and other minoritised communities.

As a Disability Confident Employer, we will offer an interview to disabled candidates who meet all essential criteria for a job where it is practicable to do so. We are also happy to make reasonable adjustments during the recruitment and selection process.

How to apply:

To apply for this role please follow the link below to the Jobs page on our website and complete the application form demonstrating how you meet the essential shortlisting criteria.

We reserve the right to close this vacancy early, if we receive enough suitable applications to take forward to interview prior to the published closing date. If you have already registered & started an application, then we will contact you to advise of the amended closing date wherever possible.

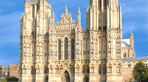

Wells Cathedral is on an exciting journey.

We have embarked on an ambitious ten-year plan. We are on a mission to become the UK’s most joyful cathedral, and we want to have a genuinely positive impact on individual lives, on the City of Wells, the County of Somerset and far beyond.

We are carefully conserving our stunning world-class, 850-year-old heritage site, and we remain committed to being a beacon of light and hope, a sacred space of prayer and a place of wonder – now and for generations to come.

We also want to elevate our brand and grow our visitor numbers. We are investing in making our visitor experience even better, for everyone. We want to ensure Wells Cathedral is known as one of the UK’s top ‘must see’ tourism attractions, and we want to reach and engage a much wider range of people. And as part of that mission, we are now investing in growing our Marketing & Communications Team.

Wells Cathedral’s Marketing & Communications Team delivers direction and support across all areas of Cathedral life, including visitor experience, fundraising, worship and music, events, venue hire, library and archives, as well as our Cathedral Shop and Loft Café. The Team covers the full scope of marketing and communications activities, including researching and identifying target audiences, designing strategic marketing plans, generating earned media exposure through PR activity, developing and implementing brand identity, and delivering integrated campaign creative across social, digital, print, broadcast and OOH channels.

Reporting the Director of Marketing & Communications, the Marketing & Communications Assistant will play a significant role in supporting the delivery of all of this, effectively and efficiently, across the organisation. This is a truly unique early career opportunity for an ambitious marketer looking to gain hands-on experience across a wide range of disciplines.

Key Responsibilities:

- Supporting efficient workflow by responding to incoming requests and scheduling projects

- Enhancing online customer experience and engagement by providing real-time responses to social media DMs, comments and reviews

- Timely display and removal of onsite promotional and information banners, posters, flyers and POS material

- Assisting the Director of Marketing & Communications, Head of Filming and Content Creator during film crew, photographer, influencer and media visits

- Assisting the Director of Marketing & Communications in strategic marketing campaign planning

- Actively participating in team meetings both within Marketing & Communications, and with stakeholders across the organisation

- Supporting the Content Creator in capturing photographic and video content at services, events and activities, as required

- Assisting the Design and Digital Services Executive in the production of on-brand artwork for corporate literature, signage and point-of-sale material

- Ensuring website content is always up-to-date

- Capturing marketing performance data to create KPI dashboards and inform campaign strategies

Person specification

Criteria

Essential

A clear and demonstrable interest in marketing and communications, with ambition to progress within this field

Excellent written communication skills and a confident proof-reader

A professional approach to both internal and external communication

An eye for audience-appropriate graphic communication, including typography and photography within brand guidelines

A specific interest in working within the arts, culture and heritage sector

An understanding of online data analysis for monitoring and informing marketing

A confident and collaborative team player, able to work with direction

An energetic and enthusiastic creative thinker

Ability to meet deadlines and remain calm under pressure

Able and willing to attend occasional evening and weekend events as required

Demonstrable commitment to safeguarding and promoting the welfare of children, young people, and vulnerable adults

Desirable

A marketing-related qualification at degree or diploma level

A good working knowledge of Microsoft 365 applications, including Word, Excel and Powerpoint

Demonstrable experience of using Adobe Creative Cloud applications such as InDesign, Photoshop and Acrobat

Demonstrable experience and/or knowledge of any of the following subjects: Christianity, Tourism, History, Music, Live Events, Hospitality, Retail

A confident verbal communicator

An understanding of marketing campaign strategies

Main Terms and Conditions

Employment status: Permanent contract of employment

Location: Wells Cathedral Offices, Wells, BA5 2RB

Hours of work: full-time, 35 working hours per week (Monday to Friday). Flexible working will be considered.

Remuneration: £25,000 per annum, payable on the 24th of the month or the nearest working day thereto

Discount: A discount of 10% is available from the Cathedral Shop and The Loft Café.

Parking: Limited parking is available in the Cathedral car park. Cars are parked at the risk of the owner.

Pension: Defined Contribution Scheme. Contributions as % of salary:

Age Employee Employer

<50 3% 5%

50–55 4% 8%

>55 5% 10%

Expenses: All reasonable working expenses will be met in line with Cathedral policy.

Holiday (inclusive of bank holidays): 6.8 weeks per holiday year. The holiday year runs from 1 January to 31 December.

Probation: This post will be subject to a probationary period of 6 months.

How to Apply

To apply, please fill in the Application Form and Equal Opportunities Monitoring Form available on the Vacancies section of Wells Cathedral's website and return them to the HR Manager.

Closing date: 9am Friday 20 February 2026

Shortlisting date: Monday 23 February 2026

To ensure the fairness of the selection process, shortlisting will be based upon the information which you provide in your application and assumptions will not be made about your experience or skills. We will look for demonstrable evidence that you meet the criteria set out in the Person Specification. Information provided on the Application Form will be viewed by HR, the recruiting manager, and interview panel. All applicants will be notified of the outcome of the shortlisting process.

Interview date: Wednesday 4 March 2026

Further details about the selection process will be provided to shortlisted candidates.

The appointment will be subject to the completion of pre-employment checks, including references and a satisfactory basic DBS check.

Safeguarding

We are committed to the safeguarding and protection of all children, young people, and adults, and the care and nurture of children within church communities. We will carefully select, train, and support all those with any responsibility within the Church, in line with Safer Recruitment principles.

This means that we will:

· Ensure that our recruitment and selection processes are inclusive, fair, consistent, and transparent;

· Take all reasonable steps to prevent those who might harm children or adults from taking up positions of respect, responsibility, or authority where they are trusted by others; and

· Adhere to Safer Recruitment legislation, guidance, and standards.

The successful candidate will be required to complete a Declaration of Suitability as part of our recruitment process when an offer of employment is made. This form is strictly confidential and, except under compulsion of law, will be seen only by those involved in the recruitment process. All forms will be kept securely in compliance with the UK General Data Protection Regulation and the Data Protection Act 2018.

Please fill in our Application Form and Equal Opportunities Monitoring Form.

At Wells Cathedral, our mission guides what we do as a church and organisation, while our values shape how we do it.

Location: Contracted to our Peterborough office with the flexibility for hybrid working

Salary: £42,000 - £48,000 depending on experience

Contract Type: Permanent

Full Time: 37.5 hours per week

Benefits: We want all our employees to feel valued and engaged and are committed to offering a positive working culture along with a good work-life balance. As well as ensuring we pay our employees fairly, we offer the following benefits: Flexible working, Generous annual leave, Private Medical Insurance, including dental and optical, Pension Scheme, Sick Pay, Death in Service, Employee Assistance Programme, Bike Loan Scheme, Cycle2Work Scheme, Eyecare, Discount Portal.

Closing date: Wednesday 18 February 2026

Telephone interviews will be held week commencing 23 February 2026

Interviews will be held week commencing 2 March 2026

No agencies please

Be a part of an energetic and vibrant team who are driven by the desire to improve the lives of people living with kidney disease. Our vision is the day when everyone lives free from kidney disease.

To achieve this, we are harnessing the power of data science and AI to accelerate research and deliver meaningful patient benefit. This is an exciting opportunity to join Kidney Research UK at a pivotal time as we develop and deliver a bold Data Science and AI Strategy that will position us at the forefront of innovation.

As data science programme lead, you will champion data science both within the organisation and externally. You will work closely with senior stakeholders across the clinical, research and industry communities to develop and drive impactful projects. Internally, you will be the go-to person for the data science programme, supporting the development of our strategy and enabling collaboration across teams including fundraising, communications and partnership development. You will also engage with funded researchers to capture and promote outputs, identify opportunities for investment and ensure our work translates into real benefits for patients.

We are looking for someone with a strong background in health sciences, life sciences or data science, combined with excellent programme management skills and the ability to communicate complex concepts clearly. You will have the confidence to build relationships, influence stakeholders and manage multiple projects simultaneously. If you are passionate about making change happen and want to play a key role in shaping the future of kidney research, we would love to hear from you.

If you are interested in the position, please complete the online application form and submit together with your CV.

We are committed to providing equal opportunities for everyone and encourage applications from all sections of the community.

About Kidney Research UK:

Kidney Research UK is the leading charity in the UK focused on funding research into the prevention, treatment and management of kidney disease. Our vision is the day when everyone lives free from kidney disease and for more than 60 years the research, we fund has been making an impact. But kidney disease is increasing as are the factors contributing to it, such as diabetes, cardiovascular disease and obesity, making our work more essential than ever.

At Kidney Research UK we work with clinicians and scientists across the UK, funding and facilitating research into all areas of kidney disease. We collaborate with partners across the public, private and third sectors to prevent kidney disease and drive innovation to transform treatments.

Over the last ten years we have invested more than £71 million into research. We lobby governments and decision makers to change policy and practice to ensure that the estimated 7.2 million people living with all stages of kidney disease in the UK have access to the most effective care and treatment, and to make kidney disease a priority.

Most importantly, we also work closely with patients, ensuring their voice is heard and is at the centre of everything we do, from deciding which research to invest in to how we plan our priorities and our work across the charity.

Those patient contributions are vital, always helping us and our partners to understand what life is like with kidney disease, always ensuring we see the patient behind the treatment and always reminding us that behind every statistic and every number is a person – the patients and the carers who inspire our mission and push us forward to make a difference and change the future of kidney disease.

You may also have experience in the following: Data Science Programme Lead, Head of Data Science (Healthcare / Health Research), AI Programme Lead (Health or Life Sciences), Director of Data Science, Data & AI Strategy Lead, Health Data Science Lead, Clinical Data Science Lead, Research Data Science Manager, AI in Healthcare Programme Manager, Life Sciences Data Science Lead, Health Informatics Lead, Biomedical Data Science Lead, Data Science Research Programme Manager, Digital Health & AI Lead, Data Innovation Lead (Healthcare / Research), Charity, Charities, Third Sector, Not for Profit, NFP, etc.

REF-226 231

Actively Interviewing

This organisation is scheduling interviews as applications come in. They're ready to hire as soon as they find the right person. Don't miss your opportunity, apply now!

Tools With A Mission (TWAM) is a Christian charity dedicated to empowering people to create their own livelihoods. We collect unwanted tools from across the UK, refurbish them into professional trade kits, and ship approximately 25 containers - over 200 tonnes of equipment - annually to support around 500 skills training centres, churches and charities in seven countries.

As Logistics Coordinator, you will oversee our ʻlocal-to-globalʼ supply chain, ensuring that refurbished toolkits reach our partners in Africa efficiently. You will plan shipping loads, prepare and coordinate shipping, control stock and inventory, liaise with stakeholders, control and analyse costs and movements, and network with in-country teams and recipients.

Giving communities tools to build a future for themselves.

The client requests no contact from agencies or media sales.

Actively Interviewing

This organisation is scheduling interviews as applications come in. They're ready to hire as soon as they find the right person. Don't miss your opportunity, apply now!

Senior Supervising Social Worker

When registering to this job board you will be redirected to the online application form. Please ensure that this is completed in full in order that your application can be reviewed.

Salary: £41,208 per annum + £750 Homeworking Allowance per annum + £1,500 OOH allowance per annum + £500 OOH referral allowance per annum & £4,184 London weighting per annum- (if eligible)

Hours: 35 Hours per week

Contract: Permanent - Full-time

Location: Home-based, with regular travel required to support children and young people in foster families in East, West , North London, Essex & Hertfordshire. Travel also requires the postholder to attend staff meetings and team away days in South and Central London

As a ‘not for profit’ organisation, TACT puts the needs of our children and carers first and look to appoint individuals who are as passionate about fostering as we are. We are a homeworking organisation, and we pride ourselves on our flexible working opportunities, available from day one, an extensive wellbeing programme and our benefits package, all curated to nurture a healthy work life balance for all our employees so they can give an excellent service to our carers and the young people and children we care for.

TACT invests all surplus income into services, staff, carers, and child development. This means that we have been able to invest unique projects like TACT Connect, our unique and ground-breaking scheme for TACT care experienced young people and adults, as well as our expanding Education and Health services. All our activities are built on our commitment to becoming a fully trauma informed organisation, in line with our key values and ethos.

We will also invest in your learning, supporting your growth and development during your employment with TACT. You will be encouraged to attend personal and professional development opportunities and will have access to learning and resources to empower you to advance your knowledge and skills.

In 2024 TACT became one of the top 5 charities to work for in the UK, placing 5th in the UK Best Companies Work For survey results , and a top 25 mid-sized company to work with across the whole of the UK. 97% of our people feel proud to work with TACT and think that TACT cares about their wellbeing, while 92% of our people would say they “ love working for TACT”.

As a Senior Supervising Social Worker with TACT London & South East, you will be a part of our fantastic team of professionals, working with our organisational values here at the heart of our everyday practice.

The successful candidate will ideally be based in or around East, West, North London, Essex & Hertfordshire, as travel to these areas will be required. Alongside travel to attend staff meetings and team away days in South and Central London

The main role requirements for this role include:

- An appropriate social work qualification

- Up-to-date registration with the Social Work England

- A minimum of 2 years post-qualifying experience in fostering/family placements or other childcare settings

- Experience in supporting and supervising foster families to meet the complex needs of the looked-after young people

- A proven track record in working with and on behalf of children, respecting and maintaining their individuality and promoting their positive development.

- Experience in group work and/or delivery of training.

- Up-to-date knowledge of relevant legislation, including the Fostering National Minimum Standards and Fostering regulations.

- Experience of working with/supporting looked-after children and their foster carers.

- Ability to prioritise, plan and self-organise efficiently.

- Capable of using electronic records systems and IT effectively, including participating in virtual meetings and webinars.

TACT offer an excellent employee benefits package, including:

- 31 days paid holiday plus 8 annual bank holidays.

- Progression to salary target rate upon completion of 18 months service.

- 45p per mile for business travel.

- Flexible working arrangements (including compressed hours, flexibility around core hours, volunteer days policy).

- Family-friendly policies.

- Homeworking ‘bundle’ including annual allowance, IT equipment and a loan for home office set up.

- HelpatHand Employee Assistance Programme (including CBT counselling, 24/7 remote GP appointments, physiotherapy, mental health support and second opinions on serious diagnosis).

- An hour a week of live, expert-led activities through the Annual Employee Wellbeing Programme.

- Menopause Policy and free Menopause Clinician Appointments.

- Stakeholder Pension Scheme (salary sacrifice).

- Fantastic learning and development opportunities for all roles.

An Enhanced DBS clearance is required for this role and will be processed by TACT on your behalf.

Closing Date: Wednesday, 18th February 2026

Interview Date: Thursday, 26th February 2026 (via Microsoft Teams)

Safeguarding is everyone’s business and TACT believes that only the people with the right skills and values should work in social work. As part of TACT’s commitment to safeguarding, we properly examine the skills, experience, qualifications, and values of potential staff in relation to our work with vulnerable young children. We use rigorous and consistent recruitment approaches to help safeguard TACT’s young people. All our staff are expected to work in line with TACT’s safeguarding policies.

We reserve the right to close a vacancy earlier than advertised if the volume of applications is excessive, you are therefore advised to apply at your earliest convenience.

TACT does not accept unsolicited CVs from external recruitment agencies, nor the fees associated with them.

Grade: NJC Point 16 - £18,310.80 per annum (FTE £30,518)

Hours: 22.5 hrs per week (excluding breaks)

Days: To be worked over three days, including a Monday

Contract: Permanent contract, subject to funding and the successful completion of a 6-month probationary period

Responsible to: Deputy Chief Executive

Place of work: Salford CVS’ offices in Eccles, Salford, M30 0FN.

Main Purpose of the Post

To take the lead for Human Resources within Salford CVS, under the direction of the Deputy Chief Executive.

Salford CVS is recruiting a proactive Human Resources Officer to lead our HR function. Working closely with the Deputy Chief Executive, you’ll manage HR records, support recruitment and induction, ensure compliance with legislation and GDPR, and maintain up‑to‑date HR policies and processes. You’ll also coordinate staff training, benefits, and HR metrics to support organisational development.

This role is ideal for someone organised, confident with HR systems, and passionate about supporting a positive workplace culture.

Specific Duties

- Maintain all Human Resources records for staff members including holiday and absence records, staff appraisals and reviews

- Ensure that current Human Resources legislation is being correctly implemented across the organisation.

- Identify and recommend areas for system improvement

- Ensure that appropriate policies are in place and being followed by the workforce

- Support recruitment process lifecycle

- Support staff inductions and help staff to understand Salford CVS policies and values

- Coordinate any external staff benefit schemes, for example Hospital Saturday Fund

- Coordinate staff training and development requirements and to incorporate these into an organisation-wide training and development plan

- Compile and analyse information on HR issues, training, or other areas within the remit of this job function

- Use and manage SharePoint and MS365 tools to support Human Resources processes and document management

- Ensure compliance with GDPR and data protection regulations for all Human Resources records and processes

- Monitor and report on Human Resources metrics (e.g., turnover, absence rates) to inform decision-making

To apply

Please complete our online application form via the ‘Apply’ button.

If you would like to know more about the role, or would prefer a paper copy of the application form, please email our recruitment team.

Closing Date: 12 noon, Monday 16th February 2026

Interview Date: Friday 27th March 2026

Actively Interviewing

This organisation is scheduling interviews as applications come in. They're ready to hire as soon as they find the right person. Don't miss your opportunity, apply now!

Project Officer

When registering to this job board you will be redirected to the online application form. Please ensure that this is completed in full in order that your application can be reviewed.

Project Officer, Flexible

Northwest – Leeds or Manchester

£29,235 per annum (pro rata for part time)

Ref: 122REC

Part time: 30 hours per week – we are happy to talk flexible working

Base: Hybrid working from either Leeds or Manchester Hubs

Contract: Permanent

ABOUT THE ROLE

Team: Active Journeys

As a Flexible Project Officer, you’ll play a key role in delivering a variety of exciting walking, wheeling and cycling initiatives, stepping into different projects where your skills are needed most. No two days are the same, and you’ll thrive in a fast‑paced role that keeps you curious, proactive and making a real impact in communities.

What You’ll Be Doing

- Planning and delivering a diverse mix of walking, wheeling and cycling projects, as guided by your line manager.

- Working as the sole project officer or be part of a team working on larger projects. This could include working with the National Cycle Network team, Infrastructure team, Active Journeys team or Connected Communities team.

- Proactively involve volunteers in projects and activities wherever possible, including recruiting, training and providing ongoing support.

- Engaging with a broad range of internal and external stakeholders whilst undertaking project delivery.

This role is ideal for someone who enjoys being out in the community — whether that’s leading walks, running Dr Bike sessions in schools, or co‑designing neighbourhoods with Urban Designers to help more people walk, wheel and cycle.

ABOUT YOU

We’re looking for someone who has experience and understanding in the areas listed below. You don’t need to meet every requirement — if you feel you’d be a good fit, we encourage you to apply.

- Experience managing small, clearly defined projects, or delivering specific work packages as part of a wider project.

- 3 years’ work experience working with schools and/or community groups, which may include voluntary work.

- Strong understanding of active travel and the challenges faced by communities experiencing inequalities.

- Knowledge and understanding of behaviour change theories and tools.

WHAT WE OFFER

We want you to feel supported, valued, and empowered in your role. That’s why we offer flexible working, a positive team environment, and benefits designed to support your wellbeing, finances, and family life.

Wellbeing Support

- 28 days’ leave per annum plus bank holidays for full-time employees

- Option to buy an extra week of annual leave (pro-rata for part-time employees)

- Paid volunteer days to support causes you care about

- Free, confidential support service available 24/7

- Access to cycle-to-work schemes through Green Commute Initiative and Cycle Scheme

Financial Benefits

- Group Personal Pension scheme with a 6% or 7% of basic salary contribution being matched by Walk Wheel Cycle Trust

- Bike, computer and season ticket loans

- Discount benefits

- London Weighting Allowance of £4,530 per annum for all those living within a London Borough (32 local authority districts plus the City of London).

- Death in Service benefit – 3 x annual Salary

Family Friendly Policies

- Enhanced maternity and paternity pay

- Flexible Working practices (full time hours are 37.5 per week, Monday - Friday)

ADDITIONAL INFORMATION

- Application deadline: 23:59, 15 February 2026

- Interviews will be held via Microsoft Teams between the 26-27th February. To apply, please complete our online application form.

- We are committed to being a truly inclusive employer. We welcome applications from everyone from all parts of the community.

- Adjustments are available throughout the application process.

We are committed to being a truly inclusive employer. We welcome applications from everyone from all parts of the community.

Adjustments are available throughout the application process.

Our Values

- We are always learning

- Championing equity

- Taking ownership

- Delivering Together

We're the charity making it possible for everyone to walk, wheel and cycle

Are you a creative storyteller at heart, passionate about seeing media serve mission?

We’re inviting you to join Springfield Church as our Media Pioneer, playing a key role in our Pioneering Project as we develop pathways to faith on the Roundshaw Estate and support estate churches across the Diocese of Southwark.

In this role, you will create high-quality media, digital learning resources, and engaging content that tells stories of hope, transformation, and discipleship, while helping our pioneering approach reach more people.

The Role

As our Media Pioneer, you will:

-

Create high-quality digital content – videos, photography, graphics, online courses, and training modules.

-

Write and tell stories of transformation and community life in an accessible and engaging way.

-

Apply Springfield’s and the Project’s visual identity consistently across media outputs.

-

Support pioneering ministries by working closely with our Pioneer Project Directors and wider team.

-

Develop replicable resources for partner estate churches to use in training and digital learning.

-

Build and train volunteer teams to sustain creative storytelling across Springfield.

-

Manage Springfield’s digital platforms – websites, social media, and media libraries.

Who We’re Looking For

We’re seeking someone who:

-

Has excellent storytelling and media production skills (video, photography, graphic design, document layout).

-

Can apply visual identities consistently across platforms.

-

Is organised, adaptable, and able to manage multiple projects.

-

Has a pioneering spirit and a heart for sharing Jesus in creative, culturally relevant ways.

-

Is a practising Christian, ideally interested in joining Springfield’s community if possible.

-

Experience in estate contexts is desirable but not essential.

Key Details

-

Part-time: 2.5 days / 17.5 hours per week

-

Salary: £16,000 per annum (£32,000 pro rata)

-

Contract: Fixed term, 24 months

-

Holiday: 26 days per annum (pro rata) + 8 bank holidays

-

15% employers pension contribution, 1 retreat day per calendar year

-

26 days annual leave per year (pro rata) + 8 bank holidays

-

Flexible working (where appropriate)

-

Based at Springfield Church, Wallington

Closing Date: 27th February, 11:59pm | Interview Date: 12th March

We believe our God-given vision is to thrive like a ‘Spring Field’.

The client requests no contact from agencies or media sales.