Finance system manager jobs

About CoppaFeel!

CoppaFeel! are the UK’s only youth focused breast cancer awareness charity, and we’re on a mission to get every 18-24 year old checking their chest. We educate people on the signs of breast cancer and encourage them to check their chests monthly, so that if they notice something unusual they are empowered to contact their GP and advocate for themselves.

We do this because when diagnosed early, breast cancer treatments are more effective and survival rates are higher. Early detection can save lives.

Breast cancer does not need to be detected late, and as long as we are here and continue to be supported by people like you, we will do all we can to make sure this doesn’t continue to happen.

The Role

The Individual Giving and Legacy Manager will report into the Head of Public Fundraising and sits within the wider CoppaFeel! Fundraising Team. In this pivotal role you will leverage your individual giving digital skills, knowledge and passion to drive our fundraising efforts to new heights. Your innovative approach and data-led mindset will grow our income and supporter base, and ensure we’re on track for our mission to educate and empower young people of early detection of breast cancer.

You will need to have experience in both acquisition and retention programmes particularly in paid digital, new product development and developing multi-channel supporter journeys. You will be a great project manager, be confident in managing budgets across multiple income streams and using data to make evidence-based decisions. You will also have excellent attention to detail and a pragmatic approach to problem-solving, with the ability to generate ideas and solutions.

This is a fixed term contract of 12 months and a hybrid role, with the expectation that you will attend the London office 2 days per week. You will be required to attend the office for quarterly team meetings, department meetings and in person training, we will provide plenty of notice for when you are required to be in for these purposes.

Duties and Responsibilities

-

Development and delivery of the Individual Giving Programme across regular giving, cash, lottery, legacy and in memory activities and income streams with a digital first approach.

-

Work with the Head of Public Fundraising in developing and delivering the public fundraising strategy to support growth over the next 3 years.

-

Manage budgets against financial and non-financial KPI’s and targets. Be involved in setting budgets and regular re-forecasts, working closely with the Finance team to ensure all income and expenditure is coding and recorded correctly.

-

Develop supporter journeys across the programme and organisation, monitoring to optimise when necessary.

-

Manage external suppliers and partners to make sure that CoppaFeel! Is getting the best value for money and high quality services.

-

Lead on building the legacy programme to acquire new supporters and embed as a giving product in the organisation.

-

Manage and develop the in memory income stream with a view to grow over the next 3 years and integrate with other income streams which share the same motivation to give.

-

Embed the EDI (Equality, Diversity and Inclusion) strategy, increasing diversity in the Individual Giving portfolio; broadening our appeal, relevance and accessibility within our work.

-

Collaborate and coordinate with internal teams to amplify public fundraising and ensure delivery of projects and activities are integrated where possible and delivered successfully.

-

Future Line Management: as the organisation evolves may take on line management responsibilities, overseeing team members and fostering their professional growth

-

Ensure quality data management: Act as a data steward for fundraising, maintaining high standards of data management.

-

Willingness to work flexibly and sometimes remotely with occasional out of core hours work (time off in lieu given)

-

These duties provide a framework for the role and should not be regarded as a definitive list. Other reasonable duties may be required consistent with the grade of the role.

Skills, Experience, & Qualification

Essential

-

Detailed knowledge and experience in digital fundraising, including paid media

-

Experience in developing complex online supporter journeys and delivery platforms

-

Knowledge of individual giving programmes including prize-led fundraising and legacies

-

Experience in managing external suppliers

-

Experience utilising CRM systems (Beacon) and analysing data to provide insights, trends, performance and reporting

-

Budget development and management experience

-

Excellent project management skills

-

Strong communication and interpersonal skills

-

Ability to work effectively with colleagues at all levels across the department and organisation

-

Strong team player self-motivated, enthusiastic and passionate about working for CoppaFeel!

-

Ability to analyse data and translate insights into recommendations

Desirable

-

Knowledge of email automation, Mailchimp, and media planning

-

Fundraising or Marketing qualifications

Application information

Applications will close at the end of 8th March 2026 with the aim to commence interviews from 16th March.

We will be having a rolling interview process for this role, so we encourage early application. CoppaFeel! reserves the right to close the vacancy early in the event that we receive a high number of applications before the closing date.

Main benefits, Terms & Conditions

Annual leave entitlement: 22 days, plus office closure at Christmas, a day off for the founders Cancerversary and a day off for your birthday.

-

Employee Assistance Programme

-

Health Cash Plan

-

Access to Self Space training and 1:1 therapy

-

Core working hours of 10am to 4pm

-

Flex Friday; every other Friday off, offering the time to recharge and ensuring work life balance, while remaining available in case of emergencies

All annual leave and benefits are pro-rata'd for part time employees.

Equality, Diversity, and Inclusion

At CoppaFeel! we support a diverse range of communities and we understand that diversity within our team is central and crucial to meeting the needs of the young people we exist to serve. We strongly encourage applications from Black, and people of colour, LGBTQIA+ candidates, candidates with disabilities, from men, and from those with a lived experience of cancer because we would like to increase the representation of these groups within the charity.

We promote equality, diversity and inclusion in our workplace and make recruitment decisions by matching the charity's needs with the skills and experience of candidates, irrespective of age, disability (including hidden disabilities), gender, gender identity or gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, or sexual orientation. We recognise the value in encouraging a diverse range of perspectives, skills, experience and knowledge at the charity.

While the successful candidate will be selected purely on merit, in the event of a tie between two candidates with equal suitability, we may select a candidate with lived experience of the issues we are seeking to address through our work.

We are a Disability Confident Employer and we commit to offering an interview for all applicants with disabilities who meet our required criteria for the role. If you have any accessibility requirements or need any adjustments for the interview process please get in touch.

This role is with One Newham, and we at Your Place are recruiting on their behalf.

Contract: Permanent

Reports to: Network Coordinator

Location: Hybrid – home based, but with regular attendance of meetings in Newham

Background:

One Newham is a network of voluntary and community organisations that are rooted in local communities and work to improve the lives of people in Newham. One Newham was created so that members learn from each other, benefit from each other’s strengths and expertise and through collaboration, innovate to find the best solutions to the issues that concern local people and communities, and the funds to support these.

Our mission is to champion and strengthen local charities and community organisations. We do so by facilitating collaborative action in Newham.

Our values inform everything we do:

Inclusion

Ensure all community groups, including grassroots organisations, feel supported and valued.

Transparency

Maintain clear, open communication with members and stakeholders.

Leadership

Take bold initiatives and act as a catalyst for sector-wide growth.

Respect

Value and honour the diversity and rights of members and the community.

We have four strategic priorities that guide our work:

Connect: We connect individuals, organisations, and communities to each other, services, and opportunities. We build partnerships and networks that facilitate collective action and initiatives.

Support: We provide and commission a support programme for our members, ranging from one-to-one advice and training, to small grants and partnership funding. We help initiatives start up and keep going by adding capacity and/or hosting projects, programmes, and fledgling organisations.

Champion: We advocate for community and voluntary action, give our members a voice, and showcase their work to funders, policy makers, and anyone interested in how local activists make a difference in Newham.

Influence: We collect data and evidence of the impact of voluntary action, and policy, on the well-being of local communities. We build relationships and engage in conversations so that policies, plans, and strategies are designed to support residents, communities, and voluntary organisations in Newham.

Purpose of the Role

The Administrator / Finance Officer plays a key role in the smooth running of One Newham. The postholder will provide reliable financial administration, maintain accurate records, support budgeting and reporting cycles, and ensure effective office and administrative systems are in place, with a strong emphasis on finance.

Key Responsibilities

Finance (priority area)

• Maintain accurate financial records on QuickBooks.

• Prepare bank reconciliations and assist with cashflow forecasts.

• Process invoices, expenses and reimbursements.

• Prepare draft management accounts.

• Support annual budget preparation and monitoring.

• Administer SafeHR (online payroll system) and manage pension returns.

• Maintain grant and project financial trackers.

• Ensure compliance with financial policies.

Administration & Office Management

• Maintain administrative systems and filing structures.

• Oversee supplies, equipment and IT procurement.

• Support onboarding of staff and volunteers.

• Act as first point of contact for routine enquiries.

• Arrange meetings, take minutes and support diary coordination.

• Assist the Network Coordinator in the organisation of network events and conferences as required, including the annual conference and Green Fair.

• Prepare board papers and governance documentation.

• Maintain databases and contact lists.

IT & Systems Support

• Coordinate basic IT troubleshooting and liaise with external providers.

• Maintain equipment records, licences and renewals.

• Support development of internal processes and digital tools.

Community Hire Scheme

• Coordinate the Community Hire Scheme, set up booking procedures, payments and deposits, and coordinate collections and returns.

• Organise regular maintenance of the equipment for hire.

• Liaise with and support the Hire Scheme volunteers and ensure that their expenses are paid on time.

• Promote the scheme widely and ensure that it is taken up by local residents and community groups.

Member and Network Communications

• Maintain up-to-date contact lists and mailing groups for One Newham members and partners.

• Support the production and circulation of member communications, including e-bulletins, newsletters and event invitations.

• Upload and update content on the One Newham website and/or member portals (where applicable).

• Assist with communications for forums, training sessions and network events (e.g. creating simple flyers, booking links, reminders).

• Help ensure a consistent, timely flow of information to members about opportunities, funding, training and key local developments.

Person Specification

Essential Experience and Knowledge

• Experience in a finance-focused administrative role, ideally in a charity or small organisation.

• Strong working knowledge of QuickBooks.

• Experience maintaining financial records, processing invoices and preparing reconciliations.

• Good understanding of office administration systems and general office management.

• Strong IT skills, including Microsoft 365 (Word, Excel, Outlook, SharePoint/OneDrive) and Google apps.

• Experience maintaining contact lists or simple CRM/mailing systems.

Skills & Abilities

• High level of accuracy and attention to detail, particularly in financial work.

• Good written and verbal communication skills, with the ability to draft clear emails and simple updates for members.

• Strong organisational skills and ability to manage competing priorities and deadlines.

• Ability to handle confidential information appropriately.

• Ability to work independently and use initiative in a small team environment.

• Practical, solutions-focused approach to day-to-day challenges.

Personal Attributes

• Reliable, proactive and well-organised.

• Calm, flexible and adaptable in a changing environment.

• Confident building positive working relationships with colleagues, members and partners.

• Commitment to equality, diversity and inclusion.

• Alignment with One Newham’s mission to strengthen the local voluntary and community sector.

Desirable

• Experience using email marketing or CRM tools (e.g. Mailchimp, Salesforce, Plinth etc.).

• Experience supporting grant administration and financial reporting.

• Knowledge of charity finance regulations and good practice.

• Basic design skills (e.g. Canva) for simple flyers or social media graphics.

Our mission to solve homelessness in east London, one person at a time!

The client requests no contact from agencies or media sales.

Reports to: Assistant Director of Finance & Operations

Line Manages: Delivery Operations Manager

Salary: £52,692

Location: Central London, Hybrid

Contract: 2-year fixed term

Closing date for applications: 12pm, Tuesday 17th March 2026

Interview dates: Week commencing 30th March 2026

About the Youth Endowment Fund

We’re here to prevent children and young people becoming involved in violence. We do this by finding out what works and building a movement to put this knowledge into practice.

In recent years violent crime has risen significantly. Homicides, assaults, robberies and offences involving weapons have all seen sustained growth. We have also seen large increases in violent crime involving children and young people. This is a tragedy. Every child captured in these numbers is an important member of our community and society has a duty to protect them.

The Youth Endowment Fund (YEF) is a charity with a £200m endowment and a mission that matters. We exist to prevent children and young people becoming involved in violence. We do this by funding great initiatives, finding what works and working for change - scaling and spreading the practices that make a difference.

One of the most important things we do is ensure that our funding and commissioning processes run smoothly and deliver maximum impact. We manage significant grants and complex commissioning arrangements that support projects designed to make a lasting difference. To do this well, we need robust systems, clear governance and strong relationships with partners. This role is critical to making that happen. As our Senior Grants & Commissioning Manager, you’ll lead on optimising our grant management system Salesforce, oversee risk and compliance and drive improvements in commissioning and procurement across the organisation. You’ll be the go-to person for contracts, grant agreements, policy guidance and Salesforce, ensuring data integrity and enabling confident decision-making. By keeping everything organised and efficient, you will be helping us achieve our strategic goals and deliver on our mission.

Key Responsibilities

Your role would be to ensure our funding and commissioning processes run efficiently, compliantly and strategically. You’ll lead improvements in systems, governance and risk management, act as the organisation’s Salesforce and grant management expert, and provide strong leadership to the team which will enable confident decisions and maximising impact. A detailed list of your key responsibilities on how you’ll do this is given below:

- Grant management and system optimisation:

- Manage the organisation’s grant management system (Salesforce), ensuring functionality, accuracy and integrity of data.

- Configure and update forms, fields and workflows to support new applications and evolving business needs.

- Develop and deliver custom reports and dashboard for internal teams to enable effective monitoring and decision-making.

- Act as the primary liaison for system enhancements, ensuring continuous improvement, and day-to-day troubleshooting.

- Commissioning and procurement:

- Support the Assistant Director of Finance and Operations in delivering improvements to commissioning and procurement processes across the Programmes, Evaluation, Change and Evidence directorates.

- Ensure commissioning activities align with organisational priorities and compliance requirements.

- When required, provide support and additional resource to the Delivery Operations Manager on the execution of agreements for all teams.

- Risk management and compliance:

- Lead on negotiating terms and conditions with grantees, evaluators and researchers, escalating complex issues where necessary.

- Conduct due diligence for funded projects, ensuring compliance with organisational standards and risk mitigation.

- Maintain and control master versions of all templates, including Grant Agreements and Variations, ensuring accuracy and consistency.

- Governance and policy development:

- Develop, maintain and disseminate non-HR policies and guidance documents related to commissioning and procurement.

- Ensure governance frameworks are robust, up-to-date and embedded across the organisation.

- Training and capacity building:

- Design and deliver training sessions to build staff competency in policies, guidance and system procedures.

- Act as the organisational expert on Salesforce and grant management processes, providing ongoing support and advice.

- Leadership and team management:

- Provide direct line management, mentorship and professional development for the Delivery Operations Manager. When required during periods of peak activity, provide support and resource for their responsibilities.

- Ensure effective delegation, clear escalation routes and a culture of high team performance

Please visit our website for the full 'About You' information.

While it’s not a criterion, we’re especially interested to hear from applicants who have lived experience of youth violence.

It’s also important to us that the people we hire do not discriminate. We believe in being inclusive and giving everyone an equal chance to succeed. Applications are welcome from all regardless of age, sex, gender identity, disability, marriage or civil partnership, pregnancy and maternity, religion or belief, race, sexual orientation, transgender status or social economic background.

Hybrid Working Details

The office is based in Central London. Those living in and around the 32 London Boroughs are expected to be in the office for a minimum of 2 days per week. If you live outside of London and work remotely, you’ll be expected to work from the London office 2 days per month.

As part of our commitment to flexible working, we will consider a range of options for the successful applicant. All options can be discussed at the interview stage.

To Apply

To apply, please send a CV, your answers to the two questions below and complete the monitoring form by clicking on "Apply for this" button by 12pm on Tuesday 17th March 2026.

When applying for this role, please ensure that your cover letter can answer, within a maximum of 400 words per answer, the following questions below:

1. Please provide an example of a complex operational process you’ve developed from scratch and implemented independently. What did you do, what impact did it have, and what did you learn?

2. Please describe your experience working with CRM or database systems and provide an example of when you’ve implemented a change to how that system is designed.

You’ll be required to provide proof of your eligibility to work in the UK. As part of our commitment to flexible working, we will consider a range of options for the successful applicant. All options can be discussed at the interview stage.

Interviews will take place in the week commencing 30th March 2026, we foresee this being a one stage process.

Benefits Include

• £1,000 professional development budget annually

• 28 days holiday plus Bank Holidays

• Four half days for volunteering activities

• Employee Assistance Programme – 24hr phone line for free confidential support • Volunteering days - 4 half days per year

• Death in service - 4 times annual salary

• Flexible hours. Core office hours 10am – 4pm

• Financial support including travel and hardship loans

• Employer contributed pension of 5%

Personal Data

Your personal data will be shared for the purposes of the recruitment exercise. This includes our HR team, interviewers (who may include other partners in the project and independent advisors), relevant team managers and our IT service provider if access to the data is necessary for performance of their roles. We do not share your data with other third parties, unless your application for employment is successful and we make you an offer of employment. We will then share your data with former employers to obtain references for you. We do not transfer your data outside the European Economic Area.

We exist to prevent children and young people becoming involved in violence.

Do you want to work for a dynamic, creative, fast-paced charity?

At Action Together we see the amazing things people achieve when they work together to make the lives of others better. If you share our values: believe it’s possible, strengthen others, and be true, we’d love you to consider joining our team.

Finance Director

The ideal candidate

We seek a finance leader driven by values, with extensive experience directing finance operations and delivering top-tier financial planning, reporting, and governance. This role requires strong technical accounting abilities, exceptional communication skills, and the talent to explain complex concepts to diverse audiences.

You should be a collaborative, inclusive leader who excels at developing team members, managing risks, negotiating effectively, and guiding the organisation through periods of change. Most importantly, you must be committed to Action Together’s mission of social justice, equity, and community empowerment.

The role

The Finance Director will play a pivotal role in ensuring Action Together remains financially robust, sustainable, and compliant as a charity and employer. As a key member of the Senior Leadership Team, you will partner closely with the CEO and Board to shape a resilient business model, strengthen financial governance, and provide strategic direction that supports our mission and values.

You will lead and develop a high performing finance function, oversee annual budgeting and long‑term financial planning, and ensure high‑quality financial insight is available to the CEO, SLT and Board. The Finance Director has responsibility for the production of monthly accounts package, annual audit and statutory accounts, risk management, payroll assurance, investment strategy, and organisational compliance with Companies House, the Charity Commission, and all financial governance requirements.

You will play an integral role in supporting strong governance, working closely with the Treasurer and Board to provide clear, timely, and insightful financial performance updates, forecasts, and risk assessments.

You will also work with the Treasurer to shape investment strategy, strengthen financial controls, and uphold governance across all statutory, regulatory, and organisational requirements

Equality , Diversity and Inclusion

At Action Together we value diversity, promote equity and challenge discrimination. We encourage and welcome applications from people of all backgrounds. We are committed to ensuring that no applicant or employee receives less favourable treatment on the grounds of gender, age, disability, religion, belief, sexual orientation, marital status, or race.

In order to ensure that our workforce reflects our communities across all levels of seniority, Action Together is offering a guaranteed interview to any candidate who meets the essential criteria listed in the person specification and who is also:

- A disabled person and/or

- A member of a community experiencing racial inequality

Action Together is committed to safeguarding and promoting the welfare of all children, young people and vulnerable adults with whom we work. We expect all of our employees to demonstrate this commitment.

Right to work

We do not hold a Sponsor License and are unable to accept applications which require sponsorship to work in the UK

Please note, the successful candidates will be required to undertake a basic Disclosure and barring Service (DBS) check. A positive Disclosure of Offences will not automatically bar an applicant from being appointed and suitable applicants will not be refused employment because of offences that are not relevant.

To strengthen the Voluntary, Community, Faith and Social Enterprise sector. To enable positive social change and promote social justice.

The client requests no contact from agencies or media sales.

The Finance team provides finance and budgeting support to staff, managers and members of PCS. The department is about to embark on a digital transformation that will modernise how the Finance department operates for the Union. We are looking for a Head of Finance that will drive and lead this project whilst maintaining continuity of service operation to the union, members and staff and, to join a progressive union that values collaboration, integrity, and social impact.

Salary and Location

- Band 5, London Spine points 21-17 or Regional Spine points 23-19

- Starting salary: London £63,279 p.a. rising to £72,098 p.a. or Regional £58,877 p.a. rising to £67,689, in annual increments (pay award pending)

- PCS Clapham or Regional office

Successful candidates for the post of Head of FInance will be able to demonstrate:

You are a qualified accountant (ACA, ACCA, ACMA, CIPFA) and or have an MBA with:

- 5 years proven experience of managing a successful finance team

- Proven experience in strategic financial leadership

- Strong knowledge of financial systems, compliance, and reporting

- Project management and delivery in a financial setting

- Excellent communication and stakeholder engagement skills

- Management of internal and external audit processes

- A commitment to equality, inclusion, and the values of the trade union movement

The main duties of the Head of Finance role include:

- Strong leadership and effective management of the finance team

- Lead and manage the implementation and optimisation of a new finance system to ensure cost-efficiency through service reviews and technology adoption

- Deliver strategic financial advice to senior stakeholders

- Lead the unions financial services, focusing on complex and high-impact areas

- Support medium and long-term financial planning for the Director of Central Services and Senior Management Team

- Oversee management accounts, year-end financial reports, and budget cycles

- Ensure compliance with VAT, Corporation Tax, PAYE, and regulatory reporting (e.g., AR21)

- Provide accurate financial data and strategic insights to decision-makers

- Strengthen audit processes and investment oversight

- Ensure integrity in transaction processing and ledger management

- Maintain compliance with data protection and service level agreements

- Support supplier relationship management

Excellent people and leadership skills combined with strong analytical skills, and problem solving ability, and an understanding of up-to-date finance technology will all be essential requirements for a successful Head of Finance.

Closing date: at 12 midday on Thursday 12 March 2026

Interviews will be held in person at PCS Clapham: Wednesday 25 March 2026

About PCS

PCS is the Public and Commercial Services Union, representing many thousands of members working in the civil service and related areas.

Employer Benefits

You will have access to a generous package of staff benefits including

- flexible working (including hybrid working)

- childcare and family support

- generous maternity/paternity leave

- 32 days leave and Christmas closure

- pension scheme

- employee assistance programme

Learning and Development

The union offers a wide range of learning and development opportunities. We will work with you to support your continued professional development.

PCS Recruiting Process

We use CVMinder to manage all recruitment activities. It helps us to maintain our commitment to equality and diversity by ensuring that we are fair and compliant with our recruiting practices.

Applications must be received by the closing date and time specified.

Candidates invited for interview are required to make themselves available on the date/s specified. Interview dates cannot be changed to accommodate candidates who are unavailable to attend on the specified date.

- CVs will not be accepted. Please see the job description/person specification and follow the application process.

- PCS is working towards equal opportunities and is positive about disabled people.

- All posts can be considered on a full-time, part-time or job share basis.

Please view our guidance for applicants.

JOB DESCRIPTION: HEAD OF FINANCE

Ref: 0326

Grade: Band 5, London or Region

Salary:

London Spine points 21-17

London Starting salary £63,279 p.a. rising to £72,098 p.a.

Regional Spine points 23-19

Regional Starting salary £58,877 p.a. rising to £67,689

Location: PCS Clapham (London) or PCS regional offices

Purpose of the job:

Management and leadership of the PCS Finance Team and the provison of strategic financial advice to the National Executive Committee and other bodies.

Responsible for the management of the compilation and production of all management accounts, PCS annual audit, budgets, cash-flow and financial planning reports and annual reports.

Responsible for the integrity and completeness of the accounting records, ensuring taxation compliance.

To manage the modernisation of PCS finance system and to work with our providers to introduce digital products to support PCS primary financial accounting management system.

To engage stakeholders and drive strategic change to optimise the efficiency of the financial operations and contribute towards PCS overall strategic direction of the PCS Union.

Responsible to: Director of Central Services

Responsible for: Internal Audit & Funding Manager and Finance & Budget Manager

Contacts

External:

PCS members, elected officials and potential members. Employers, Legal, pension and other advisors. TUC, Members of other trade unions and related bodies. Senior Government Officials, Ministers, MPs, pressure groups, campaigning bodies and media, Auditors, financial institutions and Investment Managers.

Internal:

PCS staff and managers across Regions and Departments

Main duties and responsibilities

1.People Management

- Manage work allocation and workflow, future planning and support for Finance Team and Director of Central Services

- Motivate and manage individuals and the team as a whole to provide a high standard of service to develop and improve the skills and efficiency of the Finance team

- Check work standards and maintain consistent quality of delegated tasks

- Seek to continuously improve the effectiveness and efficiency of the team

- Through induction, the appraisal system and one-to-ones, identify staff training and development needs, train or organise formal/informal training for the Finance Team

- Proactively promote diversity and inclusion in line with the wider PCS approach

- Apply the staff conduct policies as and when required e.g. discipline, grievance, capability, dignity at work and IT security policies

- Provide advice and deal with complex issues related to staff management including disciplinary or grievance in consultation with line manager

- Ensure that the health, safety and welfare of staff is maintained and improved, in accordance with PCS and statutory policies

- Work effectively with lay officials. Provide advice to and lead relevant committees including the preparation and presentation of reports

- Deputise for line manager when required

2.Strategy and Advice

- Ensure the provision of strategic financial advice and guidance to a wide range of stakeholders

- Provide leadership in delivering the unions Financial Services, having direct involvement in more complex or strategic areas to support the delivery of the unions objectives

- Prepare and manage delegated budgets in accordance with the Unions overall financial policies and procedures ensuring services are delivered within the agreed budgets

- Provide medium and long term financial planning support to the Director of Central Services and Senior Management team

- Oversee reviews of service prices and providers, making proposals for savings and change, seeking to exploit changing technologies and methods to reduce costs, wherever possible, in line with budgetary and policy constraints

- Oversee statistical systems to produce reports and analyse information within the Finance department

- Monitor and report on issues and initiatives as requested

3. Strategy and Advice

- Ensure the provision of strategic financial advice and guidance to a wide range of stakeholders

- Provide leadership in delivering the unions Financial Services, having direct involvement in more complex or strategic areas to support the delivery of the unions objectives

- Prepare and manage delegated budgets in accordance with the Unions overall financial policies and procedures ensuring services are delivered within the agreed budgets

- Provide medium and long term financial planning support to the Director of Central Services and Senior Management team

- Oversee reviews of service prices and providers, making proposals for savings and change, seeking to exploit changing technologies and methods to reduce costs, wherever possible, in line with budgetary and policy constraints

- Oversee statistical systems to produce reports and analyse information within the Finance department

- Monitor and report on issues and initiatives as requested

4.Finance Systems

- Manage the introduction, implementation and continuous monitoring of a new finance system to provide effective budget management at every level of the union

- Provide detailed financial data and reporting, including management accounts and strategic advice, to the National Executive Committee/Senior Management Team

- Provide straightforward access to budgets for all budget holders to facilitate better planning and cash flow management

- Ensure resources are optimised to enable good decision-making across each command area

- Review and update where necessary current audit processes to ensure compliance with the Trade Union Certification Officer

- Provide investment oversight, forecasting, and asset management to the Director of Central Services, and produce relevant information to support spending and investment decisions

- Ensure controls are in place and adhered to, to manage management override risks

- Maintain professional financial relationships with suppliers and customers

5.Operational Management

- Oversee and ensure the integrity of the unions transaction processing at all times

- Ensure all liabilities are recorded, payments made, receipts banked and ledgers managed in line with best practice

- Ensure all service level agreements are adhered to by the Finance department, and developed where necessary

- Ensure data protection adherence and finance systems are secure

- Assist the Director of Central Services in managing relationships with suppliers

6. Group and Branch Funding

- Oversee PCS work with Special Member Auditors to ensure the completion of union group and branch audit procedures in line with rules and Finance Committee requirements

- Provide assistance to group and branch treasurers, including training courses

- Provide reports as required for the Finance Committee

- Ensure expenses are paid in line with Service Level Agreement requirements

7. Finance Training and good practice

- Participate in the dissemination of financial knowledge across the union. Organise and participate in periodic financial training programmes for budget-holders, treasurers and members

8. Communication

- Draft complex communications including briefs, reports, business cases, for internal and external stakeholders

- Draft papers, policies and regulations in relation to financial management

- Communicate with members by producing circulars and briefings, and by addressing meetings and conferences etc

- Represent PCS where necessary and liaise with outside professional bodies such as auditors

- Provide financial information as required by other areas of the Union, in particular treasurers, or other bodies

9. Team Working

- Proactively promote team working and collaboration

- Initiate, organise, lead and participate in team meetings as appropriate

- Maintain high levels of confidentiality of sensitive issues at all times

- Provide assistance to team members

- Manage and co-ordinate staff on issues arising from new working practises, one off projects, or annual projects such as conference

10.Equality

- Contribute to PCS policies on equal opportunities by developing innovative workplace strategies to tackle inequality and discrimination

11.General

- Contribute to the strategic development of the Unions policy objectives including the PCS planning process

- At all times implement and promote the PCSs equal opportunities policy adhering to the PCS Values

- Take due and reasonable care of self and others in respect of health and safety at work

- Participate in appraisal, training and development systems

- Act in a manner that enhances the work of the PCS and its overall public image

- In all work activities, comply with data protection legislation and PCSs requirements for the protection of personal information and the privacy of individuals

- Such other duties that may reasonably be required and that are within the level of the responsibility of this post

- Willing to work outside normal office hours and location on occasion. (e.g. attendance at Annual Delegate Conference)

Person Specification: HEAD OF FINANCE

Ref: 0326

Date: January 2026

Location: London or Region

ESSENTIAL FACTORS

QUALIFICATION

- Qualification in Finance and/or Business Management (ACA,ACCA,ACMA,CIPFA,) and/or MBA with minimum of 5 years' proven management experience in finance

EXPERIENCE

- People management including induction, work allocation, appraisal and conduct

- Experience of working at strategic management level in finance

- Management accounts production and compilation of year end accounts, external reports and audit processes

- Management of payroll and pensions administration

- Project management and delivery in a financial setting

TRAINING

(including continuous professional development)

- Evidence of ongoing training and continuing professional development

- Commitment to undertake job-related training

- Commitment to participation in appraisal and development review process

- Commitment to staff development

KNOWLEDGE

- Management Accountancy

- Financial management and taxation including VAT, Corporate tax and PAYE compliance

- Contract and regulatory compliance management

- Impact and use of Financial Digital and IT applications

- An understanding of and a commitment to trade unions

SKILLS

- Ability to communicate effectively using written and oral channels, including reports and presentations, with a variety of audiences

- Ability to negotiate and form effective working relationships internally and externally

- Ability to provide strategic and policy implementation advice and guidance

- Proficient with Reporting, Data Analytics tools and performance metrics

- Ability to deliver and adapt financial training to audiences without financial knowledge/expertise

OTHER

- Commitment to the application of Equal Opportunities policies and practices at work

- Understanding of own role in maintaining legal compliances within PCS (e.g. data protection; health and safety)

- Flexible approach to work and willing to work outside of normal office hours and location on occasions

Operations and Finance Officer

Pathfinders Neuromuscular Alliance

18 hours per week | £16–£17 per hour

12-month contract (with potential to extend)

Flexible / Remote working

Pathfinders Neuromuscular Alliance is a user-led national charity supporting people with muscle-weakening conditions. We provide peer support, advocacy, research and campaigning to improve quality of life and drive systemic change.

We are now recruiting an Operations and Finance Officer to strengthen our internal systems and help ensure the smooth and sustainable running of the organisation.

About the Role

This is a key Officer-level role supporting financial administration, governance processes, HR coordination and organisational systems. You will work closely with the CEO and support the trustee board.

You will not hold financial sign-off authority, but you will be responsible for ensuring processes are accurate, organised and compliant.

Key Responsibilities

-

Setting up supplier payments for CEO approval

-

Importing and reconciling bank statements in accounting software

-

Supporting budget tracking and financial record keeping

-

Inputting payroll data and liaising with payroll providers

-

Collating and submitting DBS applications

-

Tracking HR processes (supervisions, appraisals, probation reviews)

-

Organising trustee and staff meetings

-

Maintaining policy review schedules and compliance deadlines

-

Improving and documenting internal systems and processes

About You

We particularly encourage applications from people with lived experience of neuromuscular conditions or other long-term disabilities. Reasonable adjustments will be provided throughout the recruitment process and in the role.

We are looking for someone who:

-

Has experience in administration, finance or operations

-

Is highly organised and detail-oriented

-

Is comfortable using spreadsheets and digital systems

-

Can manage multiple deadlines and confidential information

-

Is confident escalating queries where needed

-

Shares our commitment to equity, co-production and inclusion

Experience in the charity sector is welcome but not essential.

What We Offer

-

Flexible working arrangements

-

A supportive, values-driven team

-

The opportunity to shape and strengthen a growing national charity

-

A genuine commitment to lived experience leadership

To apply, please submit your CV and a short covering statement outlining why you are interested and how you meet each criteria.

Interviews will be held on Monday 13th April

To apply, please submit your CV and a short covering statement outlining why you are interested and how you meet the criteria.

The client requests no contact from agencies or media sales.

DIRECTOR OF FINANCE - OPERA NORTH

STRATEGIC FINANCIAL LEADERSHIP IN THE ARTS

Opera North, one of the UK's leading opera companies, is seeking an accomplished Director of Finance to provide strategic financial leadership and ensure robust financial management across the organisation.

Reporting to the General Director, you will lead the financial operations and governance framework of Opera North and its affiliated organisations, working closely with the Board of Trustees and Senior Leadership Team to devise sustainable financial strategies that deliver the company's artistic ambitions and strategic priorities. You’ll be taking over from a well-respected senior finance leader who is moving on after years of brilliant service, leaving a legacy to build upon and facilitating a substantial handover period.

This is a senior role requiring significant experience in complex financial and regulatory environments, with strong charity accounting knowledge highly desirable. You will lead a dedicated finance team while building productive partnerships with stakeholders across the organisation, external auditors, and professional advisers.

KEY RESPONSIBILITIES

Strategic Leadership

- Lead financial operations and governance across Opera North, Opera North Trading Ltd, Opera North Future Fund and Friends of Opera North

- Contribute to company strategy across all business areas, providing financial analysis and guidance on activities, plans, targets and business drivers

- Work with the General Director and Board to develop sustainable and viable financial strategies

Financial Management & Reporting

- Provide budgets and financial modelling, offering robust challenges to planning processes where necessary

- Produce regular management accounts, annual income and expenditure budgets, improving their effectiveness as managerial tools

- Prepare information on capital expenditure, property management and reserves management to enable effective Board assessment

- Ensure timely and accurate compliance with requirements of Arts Council England, Charity Commission, Companies House and other external stakeholders

Team Leadership & Development

- Lead, manage and support the continuous professional development of the finance team

- Support the development of financial skills and awareness across budget-holders to achieve continuous improvement in financial planning, forecasting and budget management

- Develop procedures and policies to support the company's financial performance

Compliance & Governance

- Liaise with providers of professional services including auditors, tax advisers, insurers, lawyers and pension providers

- Work closely with the People Team to ensure efficient payroll and pension arrangements in line with legislative and HMRC requirements

- Maintain awareness of changes to leadership and governance legislation, communicating implications to non-finance colleagues

- Ensure an effective governance framework is in place

BENEFITS PACKAGE

- Competitive salary commensurate with experience

- 35 hours per week

- 33 days annual leave inclusive of 8 statutory holidays

- Pension scheme: Opera North contributes 5.5% of basic pay after 3 months' service (employee contribution 2.5%)

- Professional development opportunities

- Access to Opera North performances and cultural activities

- Based at the Howard Opera Centre, Leeds

ESSENTIAL REQUIREMENTS

Qualifications & Professional Standing

- Full professional accounting qualification (ACA, ACCA, CIMA)

- Professional membership of recognised accountancy body

Experience

- Senior manager or director level experience

- Substantial professional experience in a complex financial and regulatory environment

- Preparing and presenting management accounts, reports and data at board level

- Liaising with auditors and other professional advisers

- Management of a payroll function

- Managing teams

Technical Knowledge

- Knowledge of relevant legislation affecting financial reporting and taxes

- Good knowledge of VAT and Gift Aid

- Strong Excel skills

- Comfort with different accounting software

Skills & Attributes

- Excellent communication skills with ability to explain complex financial information to stakeholders with varying levels of financial knowledge

- Ability and willingness to review and improve internal systems

- Commitment to equity, diversity and inclusion

HIGHLY DESIRABLE

- Knowledge and experience in charity accounting

- Understanding of charity law and guidance

- Knowledge and experience in preparing creative tax reliefs

- Professional experience of the arts sector

ABOUT OPERA NORTH

Opera North is one of the UK's most vibrant opera companies, creating extraordinary experiences for audiences across the North of England. The organisation values creativity, collaboration and cultural impact, operating with a strong commitment to equity, diversity and inclusion.

EQUITY, DIVERSITY AND INCLUSION

Opera North promotes equity, diversity and inclusion in our workplace and makes recruitment decisions by matching our needs with the skills and experience of candidates. As we work to address underrepresentation in our workforce, we are particularly keen to hear from applicants from the global majority or those with other protected characteristics.

The successful candidate must have the right to work in the UK or be ready to obtain it.

GENERAL RESPONSIBILITIES

All Opera North employees are expected to:

- Represent company values and purpose to create extraordinary experiences every day

- Work collaboratively with all team members

- Act as an ambassador for Opera North, following all policies and procedures

- Ensure everyone visiting Opera North is welcomed and treated with respect

APPLICATION PROCESS

Broster Buchanan are acting as recruitment partner for this appointment.

To apply, please send your CV and covering letter to Lucy Rider at Broster Buchanan

Application deadline: 13th March 2026 Interviews: 25th & 26th March

For a confidential discussion about this opportunity, please contact Lucy Rider at Broster Buchanan.

If you require any adjustments to the application process, please let us know.

We are a small, dynamic charity delivering community-led projects and initiatives that seek to both empower and improve the lives of family carers living across Wales.

The Finance and Governance Officer is responsible for the day-to-day financial management, governance support, and administrative oversight of the charity. This role ensures accurate and timely reporting of financial data, effective management of budgets, and compliance with statutory and regulatory requirements for finance and audit. Additionally, the postholder provides key governance support, facilitating the smooth running of the Board of Trustees, maintaining company records, staff records, and ensuring HR policies are reviewed and adhered to.

This position is crucial for maintaining the charity’s operational integrity and supports strategic decision-making by providing robust financial insight and governance expertise.

The role will also play a key role in identifying/sourcing funding for enabling sustainability, by working alongside the Director in drafting proposals/bids.

The post will also work closely with the Project and Engagement Coordinator and Policy & Impact Officer to help support the successful delivery of our projects through budget management and supporting the production of evidence of impact reports.

This is an integral role within the organisation that brings together key organisational, financial and people skills to enable us to continue to make a meaningful impact for families across Wales.

Actively Interviewing

This organisation is scheduling interviews as applications come in. They're ready to hire as soon as they find the right person. Don't miss your opportunity, apply now!

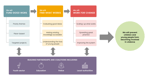

The Head of Finance supports the Finance Director in ensuring the financial health, compliance, and sustainability of St John’s Foundation (SJF), its trading subsidiaries, and associated charities.

You will lead the day-to-day financial operations, oversee internal controls and reporting, and play a key role in the next phase of the new finance system implementation which will enhance efficiency and accuracy. Working closely with the Finance Director, you will ensure that robust financial governance, accurate reporting, and effective systems underpin the charity’s strategic aims and operational delivery.

This is a senior hands-on leadership role, managing the finance team and ensuring the Finance Director, Executive Team and Board of Trustees are supported with reliable financial information and strong financial control.

For more information about the role and how to apply, please select the "redirect" button.

The client requests no contact from agencies or media sales.

Director of Finance & Operations

- Hours: 37.5 hours per week

- Location: Oxford

- Salary: £85,000 per annum

- Closing date: 26th March 2026 at 12 noon

Join Helen & Douglas House as our next Director of Finance & Operations

Help to shape the future of the world’s first children’s hospice and make a profound difference to the lives of local families.

Helen & Douglas House has been supporting children living with life‑limiting conditions and their families for more than 40 years. We are a place of compassion, expertise and unwavering commitment — and now, we are searching for an exceptional Director of Finance & Operations to help ensure we build upon our unique legacy of innovative and impactful care and support.

A role with purpose. A role with impact.

As a key member of our Executive Team and working closely with our CEO and Board of Trustees, you will be at the heart of strategic decision making — ensuring our resources, systems and operations are effective, efficient, and aligned with the needs of the children and families we serve. This is an opportunity to influence the long-term sustainability of a truly special organisation at an important and exciting time for the hospice sector.

What you’ll lead

In this role, you will provide strategic leadership across Finance, Estates & Operations, Information Systems, Data & Governance, Risk, Health & Safety and our Project Management Office.

- Providing insightful financial leadership to help shape our strategic plans.

- Oversee the annual corporate planning and budget cycle.

- Ensure strong governance, regulatory compliance and effective risk management.

- Lead our Estates & Facilities strategy, ensuring our buildings and environments remain safe, high quality and fit for purpose.

- Guide the development of an effective organisational information systems strategy.

- Support and empower a talented cohort of Heads of Department — fostering a culture of collaboration, accountability and excellence.

- Act as a trusted ambassador to regulators, partners, advisors and donors.

Who we’re looking for

You will be:

- A qualified accountant (ACA, ACCA, CIMA or CIPFA).

- A strategic and inspirational leader with experience overseeing diverse operational functions.

- Skilled at navigating complexity, shaping strategy and driving organisational performance.

- An exceptional communicator, able to build trust and confidence with stakeholders at every level.

- Passionate about making a meaningful difference through high quality, sustainable charitable services.

Experience in the non‑profit or healthcare sector is welcome but not essential — what matters most is your leadership, values and ability to deliver impact.

Why join us?

At Helen & Douglas House, every decision you make directly supports children and families facing life-limiting conditions. You will join a committed, values driven Executive Team and help to lead an organisation with a powerful mission and deep community roots. If you’re motivated by our purpose and ready to bring your expertise to an organisation where your leadership will truly matter, we would love to hear from you.

Apply today and help us secure an impactful and sustainable future for Helen & Douglas House and the families we serve.

Please note that everyone working for Helen & Douglas House are required to undertake a Disclosure and Barring Service check. Helen & Douglas House is committed to safeguarding and promoting the welfare of children and young people and expects all staff and volunteers to share this commitment. We are an equal opportunities employer and value the benefits of a diverse workforce. We positively encourage applications from all areas of the community.

Hospice charity based in Oxford, providing palliative, respite, end-of-life and bereavement care to life-limited children and their families.

The client requests no contact from agencies or media sales.

Purpose of the post

The Financial Planning & Analysis Manager will support the Associate Director of Finance to provide insightful analysis of financial trends and oversee the recoverability of funds.

They will coordinate the month-end process and work with Finance Business Partners to coordinate the quarterly forecast and the 2026/27 budget.

They will also act as Finance Business Partner to a number of teams, working closely with Budget Holders and external partners to provide effective management of resources and risk, and monitoring of quarterly partner reporting.

Main responsibilities

Financial Planning & Analysis element of role (60%):

- Coordination of month-end process: overseeing the month-end checklist and coordination of FBPs; production of monthly management accounts using JET reports

- Coordination of quarterly forecasting and annual budgeting across cost centres and funds: preparation of forecasting templates; coordination of FBPs; upload and review of forecast onto finance system

- Coordination of long-term (high level) forecasting across all cost centres and funds to end of current Core Funding cycle

- Oversee the cost recovery process of new and existing funds (overhead recovery and monitoring of funding gaps)

Finance Business Partnering element of role (40%):

- Work with Budget Holders to manage financial performance, forecasts, and budgeting including understanding financial opportunities and risk for the area of business partnership.

- Provide donor reporting and analysis as required to funders of specific programmes.

- Consolidation of quarterly partner reporting

Experience

- CCAB qualified with a minimum of 5 years practical experience in financial analysis or business partnering roles

Desirable

- Experience of fund management

- Experience of Microsoft Dynamics 365 Business Central

- Experience of JET reports

- Experience in the academic or scientific research sector

- Experience working with UKRI and/or Research Councils

- Experience of funding under Full Economic Costing (FEC) model

- Experience of managing stakeholder relationships within an academic or not-for-profit environment

Skills

- Excellent quantitative skills, use of Excel and finance systems

- Excellent written and verbal communication skills with the ability to communicate effectively and confidently with people at all levels.

- Excellent interpersonal skills and ability to handle sensitive issues positively

- Excellent organisational skills, with the ability to manage competing priorities in a fast-paced environment and to working in an agile, flexible and pragmatic way

- Ability to quickly learn and adapt to new environments

- Ability to lead and work as part of a team

- Ability to work autonomously and make decisions without supervision

- Ability to process complex information and present targeted messages to different audiences.

The client requests no contact from agencies or media sales.

Interserve is committed to working cross culturally amongst the peoples of Asia and the Arab World; to see lives and communities transformed through encounter with Jesus Christ.

We are looking for a personable Finance Co-ordinator to join our small friendly team at our National Office in Birmingham.

You will need to have a passion for Interserve’s vision and mission as well as significant hands-on finance experience. You should be qualified in Financial Management or Book keeping, with a qualification at minimum AAT level 3 or equivalent as minimum.

Good experience of accounts preparation and using an accounting system or database are essential.

The role includes:

· Assisting the Finance Manager with the preparation of draft accounts, and year-end preparation, including accounts accruals and reconciliation.

· Assisting with the transition to a new accounting system.

· Liaising with suppliers, tender applications and independent examiners and responding to audit queries.

· Processing and accounting for all supplier invoices and payments,

· Completing month end journals and balance sheet reconciliations.

· Preparing and submitting Gift Aid claims in a timely manner

You should possess excellent numeracy and accuracy with detailed spreadsheets, along with effective administration skills and the ability to handle confidential information sensitively. You should be a good communicator, both verbally and in writing and be able to work independently and as part of the Finance Team.

In return, our National Office offers a welcoming, prayerful community, with a commitment to supporting staff wellbeing and flexible working arrangements.

The salary for this role is £36,481 for full time hours. This is a hybrid role which can be worked from the office and at home, with a minimum once a week attendance at the National Office in Birmingham. Additional days on site will be required during the induction phase (up to 3 months).

In return, our National Office offers a welcoming, prayerful community, with a commitment to supporting staff wellbeing and flexible working arrangements.

Closing date: 25th March 2026

Interviews will take place at our National Office in Birmingham on 31st March 2026

Interserve is committed to safeguarding and promoting the welfare of children and adults at risk and expects all within the Interserve community to share this commitment. DBS certificates will be required for all workers.

Please follow the link to our website for further application details. Send a completed application form, CV and covering letter.

The client requests no contact from agencies or media sales.

Location: Midlands – Leicester or Birmingham (hybrid working)

Salary: £48,500 per annum, FTE 37.5 hours (we will also consider a 4-day / 30-hour week)

Contract: Permanent (we will consider interim-to-permanent arrangements)

Join a charity fighting hunger, tackling waste and creating opportunities

We are a forward-looking regional charity working across the Midlands to fight hunger, tackle food waste and create opportunities for people and communities. We believe no one should go hungry when good food is going to waste, and that everyone deserves the chance to thrive.

We are now looking for a Head of Finance to join our Senior Leadership Team and play a central role in ensuring our financial strength, sustainability and growth – so we can maximise our social impact.

The role

As Head of Finance, you will be the organisation’s lead financial expert, reporting directly to the Chief Executive and working closely with fellow senior leaders and Trustees. You will provide the financial insight and leadership that underpins strategic decisions and day-to-day operations.

You will:

- Lead the development and delivery of the organisation’s financial strategy, ensuring long-term sustainability and supporting our strategic priorities and business plans.

- Oversee all aspects of financial management, including budgeting, forecasting, management accounts and statutory accounts.

- Lead on financial reporting and liaison with the Trustee Board, including servicing and advising the Trustee Finance Committee.

- Ensure strong financial controls, including procurement, credit control, cash flow management, payroll and systems that support growth.

- Take responsibility for statutory and regulatory financial compliance, including HMRC requirements and charity/company reporting.

- Provide clear, insightful financial analysis to support decision-making, funding applications and operational improvement.

- Work closely with budget holders across the organisation, building financial understanding, ownership and accountability.

- Lead, support and develop a small Finance team of two (Finance Officer and Finance Assistant).

About you

We are looking for a values-led finance leader who is motivated by using their skills for positive social impact.

You will bring:

- Significant experience in a senior financial and management accounting role, with responsibility for budgets, management and statutory accounts, controls and reporting.

- Experience of leading a finance function, including oversight of payroll and pensions.

- Strong skills in financial planning, analysis, forecasting and budgeting, and the ability to communicate clearly and confidently with senior leaders and Trustees.

- Experience of working with or supporting a Board or Finance Committee, providing clear, insightful information and advice.

- Confident use of Excel and finance systems to produce robust, timely and accurate information.

- A proven ability to lead and develop a team, building a positive, inclusive and high-performing culture.

- Excellent interpersonal skills – able to influence, challenge and support colleagues at all levels.

- A collaborative, solutions-focused approach and the ability to manage competing priorities.

- Professionally qualified in accountancy or who can demonstrate equivalent experience.

- From any sector – charity experience is not essential. We are very open to candidates bringing transferable skills from commercial, public or other not-for-profit environments, with a commitment to learning charity-specific requirements (such as charity/SORP accounting) as part of your induction.

- A Midlands base in either Leicester or Birmingham, with hybrid working.

- Salary of £48,500 per annum (FTE, 37.5 hours), with 4-day / 30-hour week options considered.

- The expectation of a cost of living increase from April.

- The opportunity to be part of the Senior Leadership Team, shaping the future direction and impact of the organisation.

- A chance to use your finance expertise to directly support people facing hunger, poverty and barriers to work, while reducing food waste.

We are committed to building a team that reflects the diversity of the communities we serve and to creating an inclusive working environment where everyone can be themselves and perform at their best. We warmly encourage applications from people of all backgrounds and sectors, including those who may not have worked in a charity before.

We want you to have every opportunity to demonstrate your skills, ability and potential; please contact us if you require any assistance or adjustment so that we can help with making the application process work for you.

We want you to have every opportunity to demonstrate your skills, ability and potential; please contact us if you require any assistance or adjustment so that we can help with making the application process work for you.

Established in 1951, IOM is a Related Organization of the United Nations, and as the leading UN agency in the field of migration, works closely with governmental, intergovernmental and non-governmental partners. IOM is dedicated to promoting humane and orderly migration for the benefit of all. It does so by providing services and advice to governments and migrants.

Under the direct supervision of the Finance Manager and overall guidance of the Resources Management Officer and the Chief of Mission and, in collaboration with relevant units at Headquarters and the Administrative Centres the incumbent will assist in financial duties of the Resources Management Department in IOM UK.

Responsibilities and Accountabilities

-

Review and verify all types of transactions—from procurement to payment requests—to confirm proper authorization and complete supporting documentation.

-

Support financial resource management by helping to monitor and control assets, reserves, funds, and supplies in alignment with IOM policies and regulations.

-

Verify vendor claims to ensure accuracy and compliance with financial guidelines.

-

Assist in the preparation of annual budgeting submission and revisions, including preparing estimating staff costs, and forecasting expenses such as utilities, office operations, and services.

-

Extract, input, and maintain financial data across various accounting and finance systems.

-

Assist in providing guidance to colleagues on accounting, budgeting, and financial matters when needed.

-

Assist in payroll preparation by conducting accuracy and validity checks on monthly payroll results.

-

Perform claim validations against documentation to confirm that that all purchases and services are properly authorized and received.

-

Support reporting activities, including the preparation of financial, budgetary, statistical, and other operational reports.

-

Provide administrative support for staff services such as travel arrangements, expense claims, and document retrieval.

-

Maintain proper record‑keeping, keeping complete and compliant documentation for all posted payments and accounting files in accordance with established standards.

-

Support payment process from initiation to completion in accordance with established procedures and internal controls.

-

Support invoice validation and other finance operations as required.

-

Perform other related duties as required.

For more details about the role and the organisation, and to apply, please visit our website: https://unitedkingdom.iom.int/careers

Robertson Bell is delighted to be exclusively partnering with Ibstock Place School in the search for a Head of Finance. Ibstock Place is a leading independent co-educational school known for its strong academic performance, inclusive ethos, and commitment to providing an outstanding educational environment.

With significant investment in facilities and a continued focus on operational excellence, the School is seeking a commercially minded finance leader to play a key role in supporting its long-term financial sustainability and strategic ambitions.

The Head of Finance is a senior leadership position, reporting to the Bursar and working closely with Governors and budget holders across the School. You will provide strategic and operational oversight of the finance function, ensuring robust financial management, high-quality reporting, and effective governance.

Key responsibilities include:

- Lead and manage the finance team, including performance management, development, and succession planning.

- Oversee budgeting, forecasting, and financial planning processes, ensuring alignment with the School’s strategic priorities.

- Produce timely, insightful management information with clear narrative to support decision-making.

- Lead the preparation of statutory returns and annual accounts, ensuring compliance with all regulatory and reporting requirements.

- Manage the year-end process and act as the primary contact for external auditors.

- Maintain strong cash flow oversight and prepare accurate cash forecasts.

- Ensure effective financial controls, policies, and procedures are in place and continuously improved.

- Oversee the financial systems environment, ensuring it remains fit for purpose and fully utilised.

- Support and guide budget holders, promoting financial accountability across the School.

- Deputise for the Bursar on financial matters as required.

Candidate Profile

We are seeking a proactive, collaborative, and technically strong finance professional who can operate both strategically and hands-on.

Essential experience and attributes:

- A recognised professional accountancy qualification (ACA, ACCA, CIMA or equivalent).

- Proven experience in a senior finance leadership or management role.

- Strong track record of budgeting, forecasting, and financial reporting.

- Experience working with Boards, Governors, or senior stakeholders.

- Excellent understanding of financial controls, compliance, and best practice.

- Demonstrated ability to lead and develop teams effectively.

- Strong communication skills with the ability to present complex financial information clearly.

Desirable:

- Experience within education, charity, or not-for-profit environments.

Why Join Ibstock Place School?

- Opportunity to play a pivotal role in a respected and well-established independent school.

- Broad and varied remit with genuine influence across the organisation.

- Collaborative leadership team and strong organisational values.

- Chance to contribute to the continued development of facilities, services, and financial strategy.

Location & Working Pattern

The role is based on site at the School in Roehampton, South West London, with on-site presence expected to support close collaboration with stakeholders.

.gif)